The politicians and newscasters love to go on TV and tell the upbeat story of signs of an economic recovery. There’s talk about “green shoots” and excitement that the rate of unemployment isn’t rising as fast as it did last month.

Don’t buy into this garbage unless you’ve got money you don’t mind losing. Despite the confidence building exercises going on, there’s little reason to cheer the state of the economy or plan your business around a retail market that suddenly rebounds to pre-2008 levels.

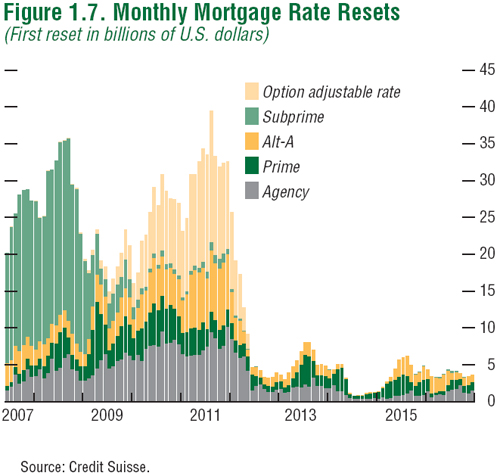

The mess that started this financial chain reaction, mortgage defaults, isn’t done playing out. While we’re in a bit of a calm point in between waves of mortgage resets, the next wave is inevitably heading toward us:

The coming mortgage resets will hit bigger loans in more expensive neighborhoods. What subprime did to modest communities, option ARMs will unleash on the McMansions.

Are these interest only loans? No, they’re even worse. Some of these “option” mortgages allowed borrowers to pay less than interest – effectively leading to negative amoritization of principle. When these minimum payments inevitably lead to 110% principle owed, home “owners” will be suddenly be required to make minimum payments that fully amoritize the debt in 30 years. Compared to the original introductory price, many borrowers will end up owing three times as much per month.

So if you thought subprime did a number on the banking system and retail, just wait until this next debt bomb explodes.

Business Outlook: Harsh

If you’re counting on income from retail and advertising, you’ve probably realized that most markets are suffering low demand and relatively high costs of production. Some niche markets are surviving and thriving, but the general outlook isn’t great. Promoters who have seen some of their sites and products fail are shifting their resources into more resistant sectors, so even the surviving markets are prone to fiercer competition.

Of course, the biggest competitor of all is the big financial houses who can afford to acquire just about any business they want thanks to practically free loans from the federal government. Obviously, an inefficient business model can’t last forever, but it can require a lot of capital to survive long enough to see the light at the end of the tunnel. Some of the biggest businesses in the country may be the most flawed, but they’ve also got the most assistance – and you, as the taxpaying, self-employed small business owner – is going to help pay for their bailout.

Adapt to Frugality

For the first time in generations, being cheap is back in style. This is one of those trends that probably isn’t going away for a while. In the 1990s, you could double the price on your product by adding a few flashy extras, but these days people can’t really afford to buy material icons of status. Even if they can afford it, it doesn’t carry the same sort of public prestige it once did. When gossips once whispered about someone’s cheapness, they often now frown on what is seen as lavish, extravagent, and wasteful.

When the great depression last truly brought frugality into style, it took forty years for the trend to turn. Now, another forty years after materialism’s reign, I would not go shopping ideas for elite versions of mundane products. What businesses should be doing is focusing on cost and reliability. Identify the utility of your products or services and bring the best price possible by cutting off unecessary extras. Get in touch with the customer any way you can – listen to them to find out exactly what is considered a core benefit and what is extraneous.

Researching and getting information from customers can be time consuming and expensive, but you can help turn it into immediate sales too if you combine surveys with coupons and other promotional offers. Also, if you create some coupon vouchers and attach them to an online poll, you can gather a higher completion rate while enjoying the other benefits of coupon marketing.

Of course, this is what’s working for my business and your model may need entirely different solutions. If you’re already selling and focusing on luxury jets, my ideas probably won’t keep your factory open 🙂

But if you’re marketing to people who work for a living, its a whole new game out there and its not going to change any time soon. If you felt like you missed out on the early web bubble, here’s your chance to get in on the ground floor of a business reality that’s going to be a lot more long-lasting than the hype and confidence games.

Leave a Reply