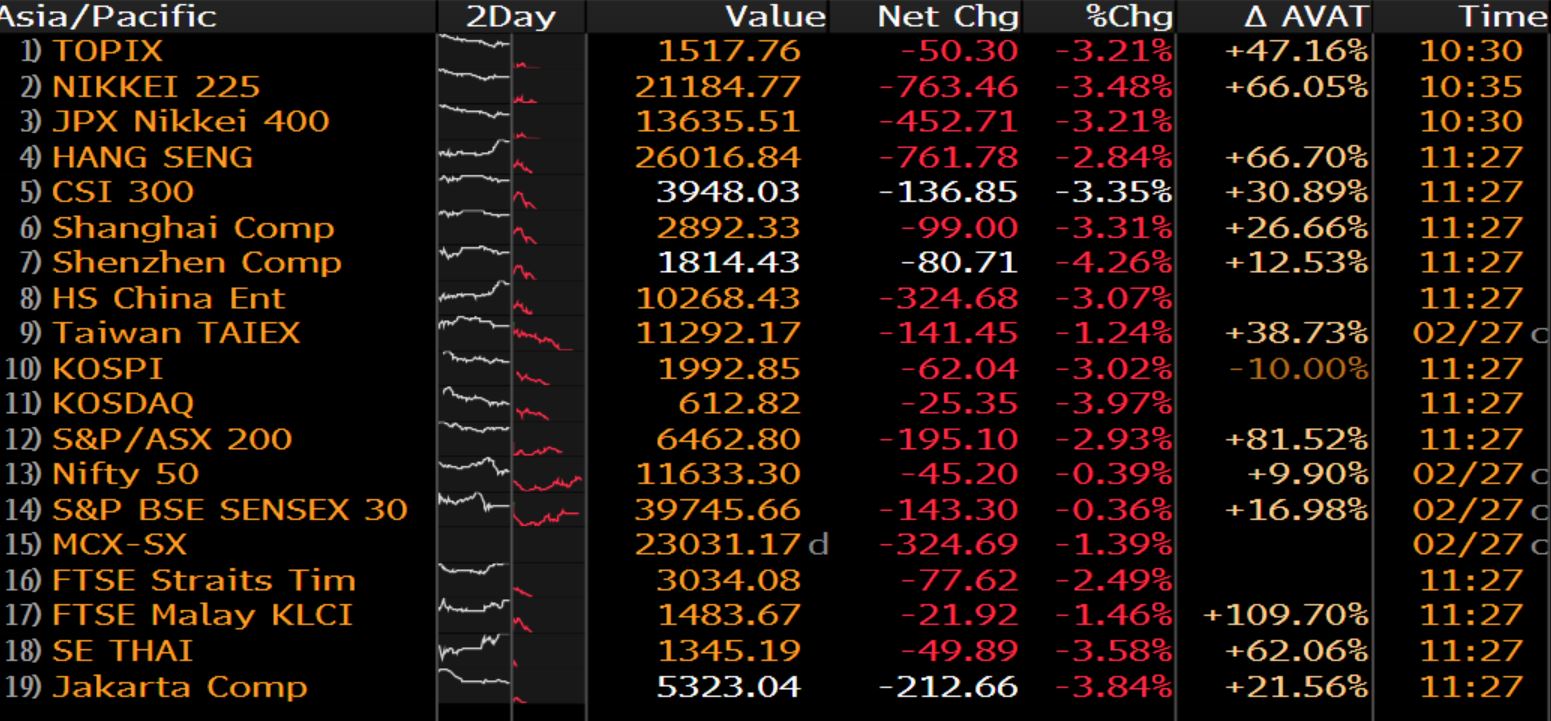

The stock market is nearing the end of one of the worst weeks in its history, and it’s still way too early to say what the full effects of Coronavirus (aka COVID-2019) will be in terms of economic activity and human cost.

Table of Contents

The Virus:

COVID-2019, as it is officially named, is a novel viral infection that is spreading from Wuhan, China and rapidly finding its way throughout the world. The basic reproduction number, or R0, is a value based on how many people we can expect to get sick per each new infection. Right now, the R0 for this virus is 2.2. So every time someone gets COVID-19, they’re likely to pass it on to 2.2 more people. This number will go down eventually – but only when so many people have already caught the infection that the herd is starting to demonstrate a little bit of immunity.

The Symptoms:

In 80.9% of cases, symptoms are classified as mild and resemble the common cold. Infected individuals are most likely to experience cough, sniffling, sneezing, and mild fever. For most people who get sick with COVID-19, they may not even be sure if they had a mild flu, cold, or the new virus that’s wreaking havoc on the stock markets.

The Big Deal:

If most cases are mild, you may be wondering exactly what the big deal is. Well, there are actually quite a few.

- COVID is much deadlier than the flu with a mortality rate as high as 0.7% to 1.5% (based on current estimates and reports from China, South Korea, and Italy).

- COVID is extremely dangerous to the elderly. While it poses little threat to younger people, it has extremely high fatality rates with older people where it commonly causes viral pneumonia.

- COVID is overwhelming medical systems with a sudden surge in demand for beds, ventilators, antiviral medications, and testing kits. Hospitals and clinics have limited space and equipment, and it’s probably too late to order more. Even if they could, the extra equipment would sit idle once the pandemic has passed.

- COVID is breaking down supply chains in Asia and Europe. Several companies have ceased production and this is causing ripple effects as more and more companies that rely on those parts are also cutting back or ceasing production. As of today (2/27/2020) Apple and Microsoft have announced expected slowdowns in hardware availability, and several European car manufacturers threatened a halt to all production if they couldn’t retrieve electronics being produced in a quarantined section of Italy.

- COVID is probably already here and you might even be infected by the time you’re reading this. The incubation period for this virus averages 10-14 days, and some cases have been identified with a gap of as much as 3 weeks between the time the person became infected and the time they started showing symptoms. You could’ve caught it at the gas station two weeks ago and you’d still have a week to go before the symptoms started up.

So it’s likely that a lot of people are going to die. And the more we try to contain the virus, the worse the economy gets. But if we don’t contain it, more people will catch it, so public health systems will become more overwhelmed and there will be more illness related disruption to business. Starting to see the problem? There isn’t a whole lot of choice here and there isn’t a whole lot we can do to stop it.

Additional Market Fears

The virus isn’t even the only thing that has markets on edge right now, although it is probably the biggest. For political and ideological reasons, there are some other villains that investors are pointing to right now:

- Donald Trump has shown stark incompetence in the handling of this – and many other national concerns. Confusion has arisen over who, exactly, is in charge of the response team, and the CDC has been cut back drastically over the last few years to help pay for this administration’s wild spending and tax cutting.

- Bernie Sanders is also scaring the other wing of the investment world. After decades of watching profits and capital’s share of the economy grow at the expense of workers, along comes a presidential candidate who wants to undo the trends set in motion by decades of neoliberalism. The standard attacks that the media and conservatives use to undermine left wing candidates don’t seem to be sticking, and his base of Millennials has put him in an early delegate lead heading in to South Carolina and Super Tuesday. And he’s no McGovern – he’s actually popular against Trump and even does well in swing states.

- Equities were already overvalued at a seasonally adjusted Case Shiller price earnings ratio of almost 30. The historical average is more like 17 or 18, suggesting stocks could take a 35% price hit before being fair value again. This is before we calculate for any slowdowns caused by COVID-2019 or political disruptions.

- The Syrian Civil War is also escalating with Russia killing dozens of Turkish troops today and Turkey seeking vengeance.

Few Silver Linings to be Found

Equities, non-food commodities, and many currencies are all in simultaneous decline as investors seek the shelter of treasuries (and other bonds, to a lesser extent). The sell off has been uniquely global with no nations spared – it is quite unlike most financial contagions that have an origin point and impact different economies in different ways. This event seems to be taking an equal cut out of every economy.

A time of disruption is coming, and a lot of money will be lost, but new opportunities are also likely. One trend we’re likely to see is another increase in work from home and remote options for employment. This had been slightly in decline lately as corporations emphasized the importance of physical proximity, but all of a sudden physical proximity has become a major liability.

There are also likely to be business failures that are bad news for the investors who are currently holding those firms, but it will be good news for the investors and startup builders who ultimately replace them. There will probably also be a lot of freelance work available since businesses will be operating at reduced capacity and looking for those who can help pick up some slack.

There will be tough times ahead, but it won’t be the end of the world or the global financial system. Losses are unlikely to be as extreme as 2008, and U.S. banks are in a much better position due to a combination of increased regulation, explicit guarantees, and a fear of taking too much risk that has been instilled in the leadership who survived the last crisis. It won’t be fun and it won’t be pretty, but we’ve seen worse in fairly recent memory.

Leave a Reply