Stocks are up in every index, housing prices have almost completely recovered to previous highs, and consumers are confident. So what’s next for the business world? Well, we may just be getting toward the end of the business cycle and biding our time until the next recession.

The boom and bust cycle, in short

In short, modern credit-based economies tend to go through periods of rapid economic growth followed by brief recessions. Why? Well, new money comes in the form of government spending or bank loans, so the economy expands when banks lend and governments borrow.

In general, increasing the money supply increases inflation: but the details matter. In a credit-driven expansion, products that are typically purchased with borrowed money tend to appreciate most quickly. So as the economy expands, real estate – and rent – becomes more expensive. Rising land prices also drive up farm rents and food prices, and mineral rights & oil prices (not to mention iron, aluminum, and rare earth elements).

The Federal Reserve can (and is attempting to) fight off inflation by raising interest rates. When interest rates go up, lending slows down and so too do increases in associated asset prices. Why would the Fed choose to slow down the economy? Well, if inflation starts to outpace wage growth, people won’t be able to afford their mortgages and they’ll turn to the credit cards to get gas or buy groceries. Eventually, this leads to a chain of defaults like we saw in 2008’s worst case scenario.

Interest rates: now & later

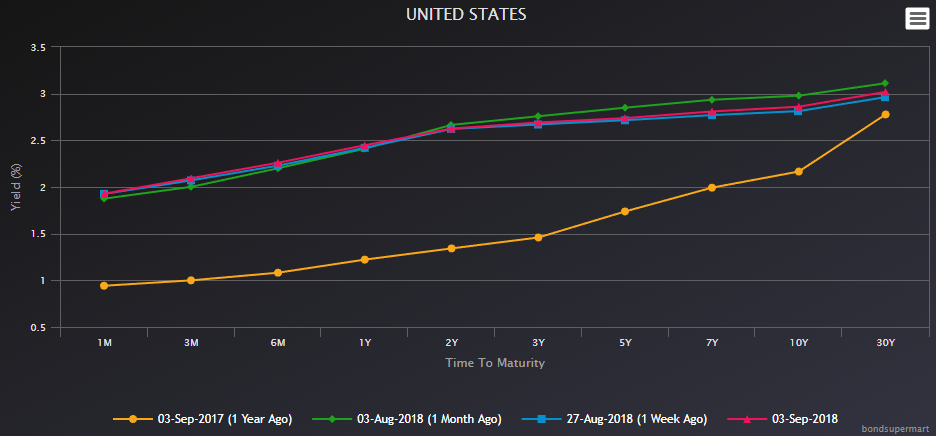

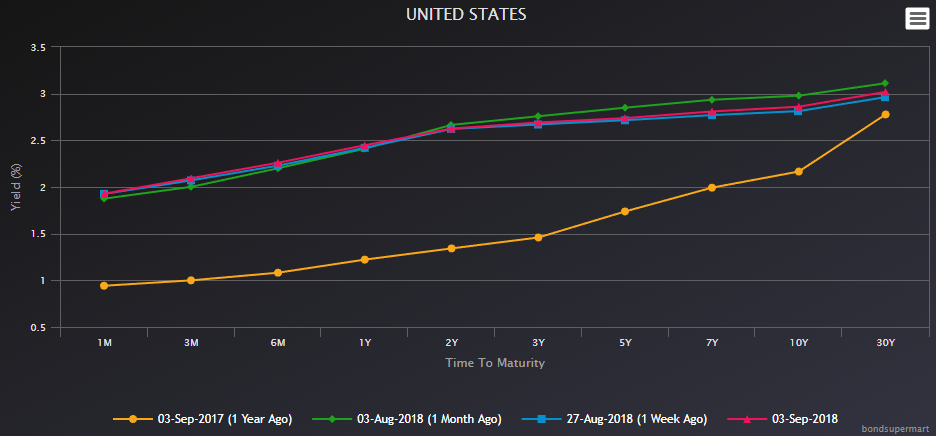

The Federal Reserve’s influence is also limited: they can change the short term interest rate by changing how much they charge to banks for overnight loans, but they can’t really change the market’s perception of five, ten, or thirty years from now. Over time, investors expect, things will trend toward the average.

Normally, long term interest rates are higher than short term interest rates. If you’re borrowing money until the bank opens on Monday, I’m less worried about the interest rate than if you’re going to need six months, a year, or ten years to pay me back. The longer I’m waiting to see my money back, the more I want in return. Normally, that is.

In fact, the chart below shows the “spread,” or the difference in interest rates between the 2 year treasury bond and the 10 year bond:

Most of the time, the 10 year rate is higher than the 2 year rate, but every time that value drops in to the negative, there’s a recession (grey shaded area) close behind. Why? Well, it typically only happens because the Federal Reserve is raising those short term rates in the hopes of preventing a total economic meltdown. It also means that investors are expecting more risk over the next year or two than they do over the average of ten typical years.

What’s that mean for the web business?

Even if we can anticipate that there’s a recession coming, this indicator doesn’t tell us if it’s going to start next month or in two years. Even with advanced analysis, timing the specifics of market movements is largely a game of chance. That said, it might be a good time to take a more conservative position: stock up some cash for a crash, and maybe avoid taking out more home equity than you can really afford to borrow.

Will the unicorns survive? Some will, in some form… but the majority of them probably won’t. If you’re working for an online business that hasn’t quite turned a profit yet, it might be time to polish off and update the resume. If you’re starting a project that’s going to require investors, get that funding secured ASAP or else build a more modest plan B that gives you a cheaper launch.

Are we going to see another catastrophe like 2008? Probably not. Although houses and stocks are a little overpriced, it’s nothing as bad as what we had in 2006-2007. Household and corporate balance sheets are in better condition, and there are a few new safeguards in place that should help prevent the worst of the chain reactions we saw a decade ago. Still, we’re likely to see drops in home prices, 401k values, the employment rate, and GDP growth. Assets will become cheaper to own, food prices will moderate, and rents will stop going up so quickly.

After a year or two of recession, starting a business or investing in future assets is even easier than late in the business cycle, so be prepared and take advantage of the opportunities available on both sides of the cycle!

Leave a Reply