The good news for web publishers during lockdown is that traffic numbers are through the roof. More people are surfing and searching than ever before.

The bad news is that advertising markets have cratered as many buyers have lost income and are now avoiding unnecessary purchases.

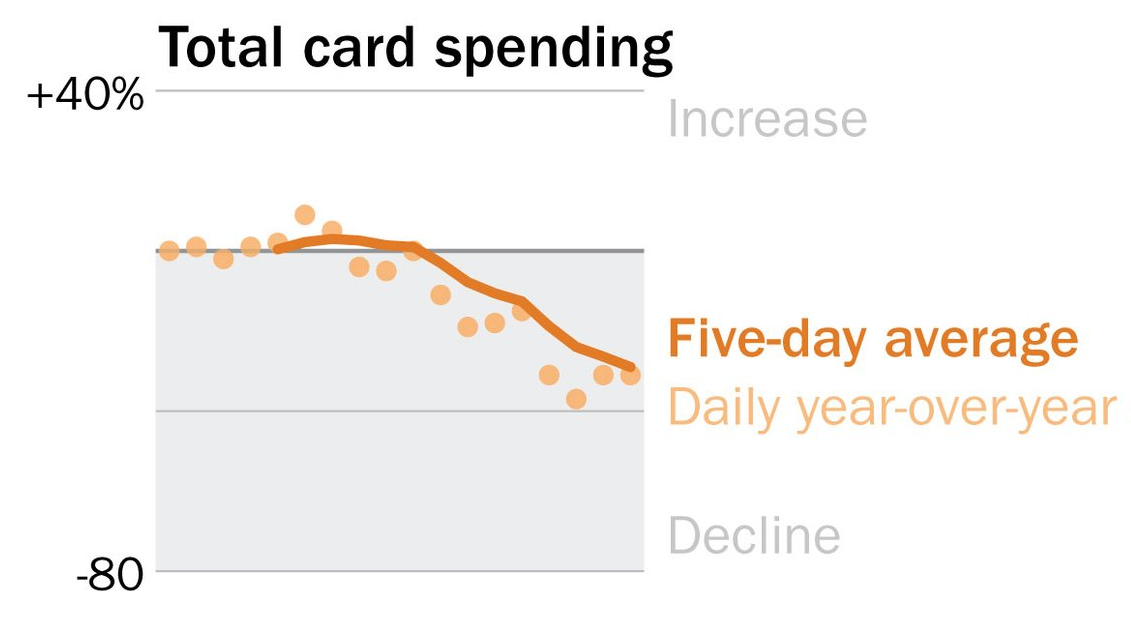

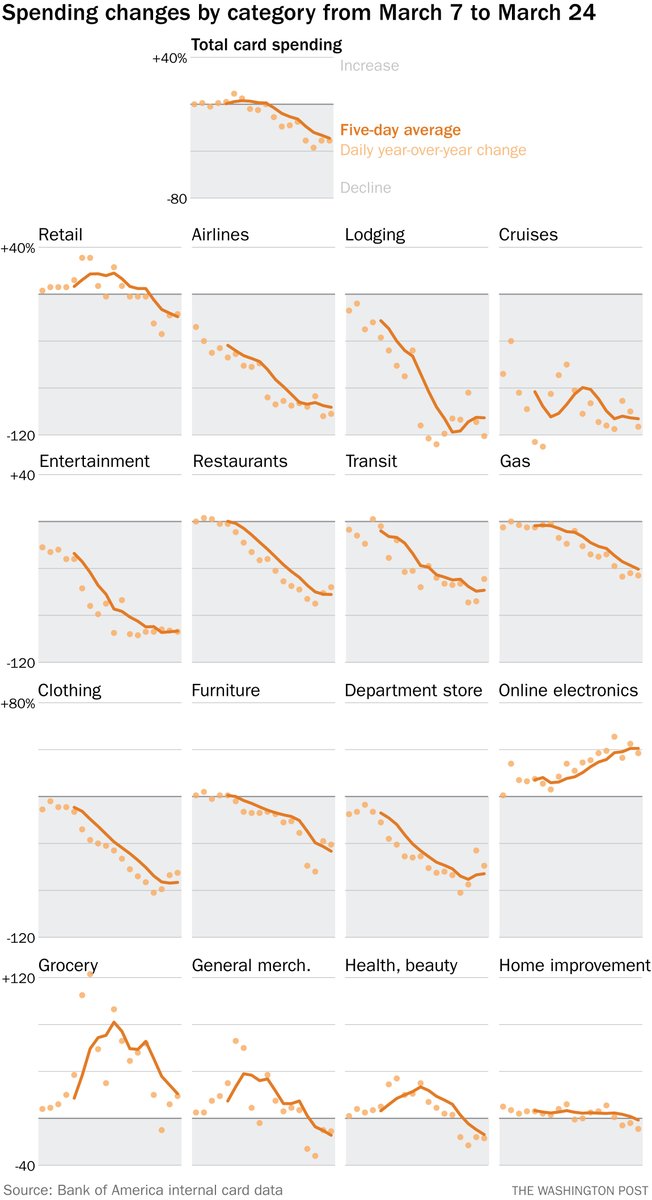

While there is at least a little bit of variation among sectors, the overall trend is impossible to ignore: spending has completely fallen off a cliff. The most bearish projections for unemployment turned out to be too rosy – and a good third of the country hasn’t even had lockdown orders issued, yet.

Based on the information tracked by Bank of America, consumer spending is down in virtually every category they measure.

If you’re looking for a silver lining, it might be the fact that web traffic is reaching all time highs. Websites and content delivery services like Netflix have struggled to keep up with the surging demand on internet networks, but they’re also struggling to make ends meet as subscribers cancel and advertisers reduce their budgets. From Adsense to the local TV news, advertising supported content is really struggling right now – even as people demand ad supported content more than ever.

Nowhere to hide

Such a broad based decline is economically unprecedented – there are usually winners and losers in any crash, not just losers.

Electronics sales have surged in the short term, but this is likely to represent consumers’ planned expenditures shifted forward in time. Why wait for Christmas to get the new game system if now is the time to use it? The short term surge in demand is unlikely to continue through the year, especially as budgets get stretched from lost jobs and reduced hours.

There’s also a problem with shortages. The virus has slowed down or completely shuttered production in China, Taiwan, South Korea, and Hong Kong, leading to major supply shortages for chips and other electronic components. Microsoft and Apple have warned that shipments are being delayed by at least six months, and customers are finding that the thing they wanted to buy is now out of stock. The Oculus Quest – a perfect distraction from the pandemic – has been sold out for weeks, and the only copies available are selling at almost twice their normal MSRP. The commission on that marked up Amazon sale might be nice, but there aren’t a whole lot of people making them.

Overall, the electronics niche will probably weather this storm better than the others, but the surge of growth we’ve seen is probably temporary at best. There’s likely to be some additional hangover in the future as the bills catch up. You’ll still be doing better than the travel blogs, but it won’t exactly be a big pay day, either.

How the mighty will fall

And the bigger they are, the harder they’re about to fall.

Growth over the last decade has largely been financed with debt. That slick corporate website that ate your SERPs? Well, there’s a good chance they’re backed by investors and they’ve got debt and dividend payments to make on a regular basis.

Many of them won’t be able to make their payments in the next few months, and that’s likely to set off a scramble of panicked investors demanding liquidation. Except it turns out you can’t really liquidate a website because all of its value comes from the regularity of content updates. Gutting the staff will simultaneously gut the value of the website, and while they might be able to ride off their purchased authority for a while, these sites will eventually fall off the rankings. Alternatively, the investors may even decide to shut the whole thing down and auction off the domain names if they have any value.

Smaller websites will struggle as well, but they’re less likely to have large debt payments or investors to appease, so they’ve got a slightly better shot at weathering the storm. When and if demand returns, new startups and nimble sites will have the best outlook, while today’s titans will still be caught up in debt related litigation.

How to survive?

Well unfortunately, a time machine may be necessary for this strategy but times like this are exactly why it is good to have a significant amount of cash saved up. Non-cash investments just took a huge hit to value and new cash flow is extremely restricted.

Some web publishers may also be able to apply for federal unemployment benefits under the $2.2 trillion bailout program. While self-employed individuals rarely qualify for state unemployment benefits, the emergency financial aid legislation passed by congress expands eligibility to 1099 workers and the self employed. Websites that are incorporated may also be eligible for federal small business assistance, although you’ll need to have had some regular W2 and/or 1099 employees of your own (in addition to the owner).

The next best option is to cut costs as much as possible, but what does that mean for a website? Well, it usually means to reduce ad spend and content development, but those are counterproductive as they also directly and negatively impact revenues. For sole proprietors, this leaves the personal and household budgets as the best places to find cost savings. This means it’s a good time to review your subscriptions and monthly bills. Cancel the ones that don’t get much use and use this opportunity to negotiate lower rates with the ones you will keep. Cell phone and internet providers are often open to price negotiations, especially if you’ve been a loyal customer for some time.

So while there are no great solutions for surviving such an unprecedented and broad based economic decline, there are some glimmers of hope and potential for the smaller and more agile web publisher. Electronics, coupon sites, and web hosting have all held on as decently strong niches, although conversion rates are definitely suffering. People are also starting to pop up with COVID related spam for n95 masks, other personal protective equipment, and other supplies related to the coronavirus pandemic.

Large shifts are unusual and difficult to adapt to, but this is the new economic order we’re up against and it’s bigger than any individual or firm or even nation. The sooner people adhere to social distancing and eliminate unnecessary travel and socialization, the sooner this pandemic is over and the sooner we’ll have a growing economy again.

Leave a Reply