I have to admit, this economic “recovery” has been pretty nice for sales and ad revenue – the only problem is that there’s no way it is going to last much longer.

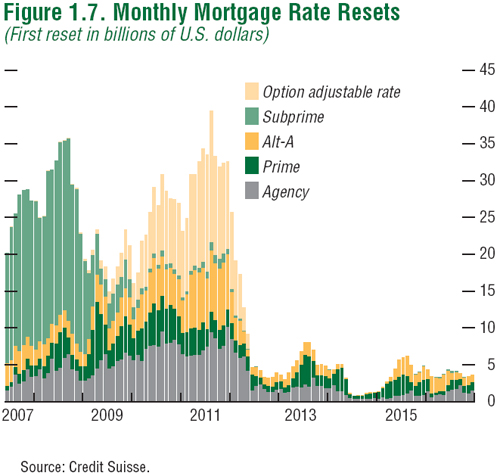

By many measures, the economic situation has greatly improved from the panics of fall 2008. There was a time there when it seemed like no one was spending on anything and no one even wanted to advertise. Unfortunately, none of the underlying issues have really been addressed and a whole new wave of mortgage resets is coming that promises to be even more brutal than the original sub-prime problem. While the total dollar volume of each reset wave is similar, the exotic ARMs that are about to implode are expected to have much higher default rates due to the way they were structured around an assumption of always rising prices. All of those teaser rates and interest-only deals are about to be forced in to a 30 year amortization plan at 2005 and 2006 prices.

Remember this chart? Its time to dust it off again:

Oops.

The one major difference that might help diffuse the panic is the amount of cash the government has stuffed in to the banks. Right now, they’re sitting on excess reserves of about $1 trillion (a gift from all the U.S. taxpayers and dollar owners around the world) but the defaults coming and their associated derivative financial instruments is likely to have a notional value that far exceeds the total of all the bailouts and transfers up to this point.

As the value of those bank assets begins to crash all over again, we might anticipate another “emergency” government action to fill up the vaults at your least favorite private bank.

Of course, that means rising commodity prices despite deflationary forces created by falling demand. The cost of making a computer goes up – but the price you can sell it for goes down. You know you’re in a bad situation when the “fix” is just as painful as the disease (the disease here being the very nature of our credit-based monetary system, or at least the way it is funneled through the banks & their investment houses before it ever has a chance to “trickle down” on the rest of us.)

The stock market is definitely taking note and beginning to anticipate the next round of crisis. Not only is there extra scrutiny regarding the deficits and structural debts in Europe, there is also extreme volatility building up in all equity markets and this has manifested in the Dow Jones Industrial Average as a steady trend down. As of Wednesday afternoon, the index even closed below 10,000 for the first time in many months.

Now I can’t say how bad it is going to be – maybe the economy will just freeze up for a few more months before people in Congress wake up. Maybe things will be even worse than last time as the new crash effects cascade and amplify the shaky ground we’re already on. There is definitely a lot of polarization and extremism going on in the political debate, and a financial panic in the heat of summer could be the kind of spark that sets off a really bad situation. I hate to be pessimistic – and we can all hope for the best – but it might be a good time to prepare for the worst. So if you’ve got a chance to grab up work at a predictable wage, take it while it lasts even if it means you’re working ridiculous overtime or something. In a couple of months, those kind of opportunities might not even exist! Otherwise, get ready for some fierce competition for web traffic and online sales. This next wave is likely to shake a lot of players out of the market though, so if you can survive this next year it might just be a good ride after that.

hey John,

Do you mean that one can’t live beyond one’s means forever? I thought this was the new paradigm. 🙂

Seriously though, the US is racking up a serious amount of debt that someone is going to have to pay off some day…

But maybe it’s better if we just stick our heads back in the sand and don’t look at things like that mortgage chart you posted (that I’m well aware of)…

Unfortunately, I have to agree with you… a second wave is heading our way… and it’s a big one. kowabunga, baby!

We have seen more indications that people are unwilling to spend then they were previously. I think people are simply sick of living in debt.