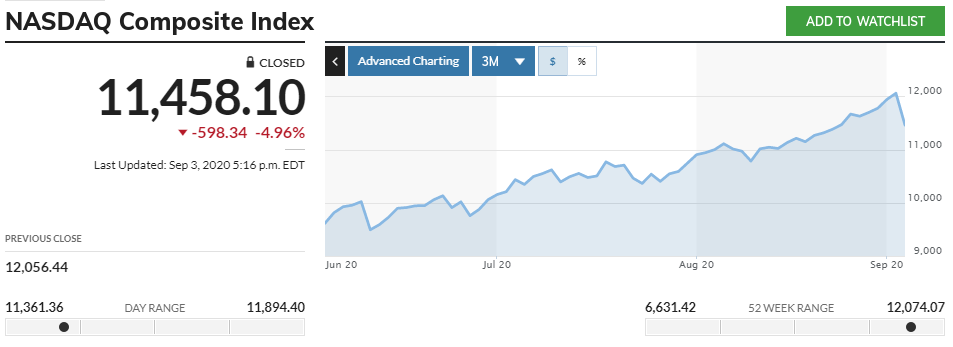

While the big drop in stock markets made big news yesterday, it’s also worth noting how little this does to bring valuations back down to reality. In fact, after the drop, the NASDAQ is only down to where it was last Wednesday (August 26).

“Even the most bullish speculators chasing momentum would have found it difficult to justify buying at such extreme levels”

Fawad Razaqzada

Will this correction be enough to justify valuations going forward, or is it just the beginning of a trend reversal?

Tech leads rallies, then leads declines

Since the market has rallied off its mid-March lows, the recovery has largely been led by tech stocks. Amazon, Zoom, and especially TESLA have all rocketed off toward record highs. While there’s some truth to the fact that current economic conditions favor technology and web-based businesses, there are also some similarities to the excessive enthusiasm of the dotcom bubble.

After reviewing the evidence, I have to conclude that both cases are correct. Technology and digital industry is growing much faster than traditional companies and firms with less focus on innovation. There’s also a massive bubble forming, and yesterday’s pullback isn’t enough to say we’ve found a stable foundation.

While stocks like Tesla and Zoom are among the biggest breakout stars in the rally, they’ve also been the hardest hit this week. TSLA shares are down to around $400 right now after having recently peaked at $500. ZM shares are down to $375 after peaking at $457.

Even Amazon took a hit, with shares falling almost 5%. While that’s a larger total value than Tesla or Zoom, it’s important to remember that it’s also a much smaller percentage of the total share value. While Amazon and other solid NASDAQ stocks aren’t the froth, they are getting caught up in a larger bubble that’s being enabled by index ETFs.

Sorting value from hype

Now is definitely not a good time to buy in to companies that are primarily selling hype. It’s also not a good time to buy in to stocks that are lock-down focused. We’ve already been aware of this virus for nine months now, and early vaccine candidates are getting ready for wider testing. There are likely to be further delays in studying efficacy and sorting out distribution details, but many of those early 2020 business trends are set to reverse – even if only partially.

Companies like Amazon and Google feel more solid – they’re at or near their historic PE ratios and they’re still set for at least historically average growth even if people do start to go out more often. Google may have some legal and political troubles regarding antitrust hearings, though, so that adds a bit more risk to the stock than usual.

Jobs and vaccine news

Markets are partially recovering this morning since the monthly jobs report indicated that the unemployment rate has dropped to 8.4%. Yesterday’s “positive” report wasn’t taken as well, since a large amount of confusion and doubt resulted from the sudden and non-transparent change in methodology. Had the losses been measured as they had the previous week, it would have shown the rate of losses increasing – not declining.

This morning’s jobs report also shows a large decline in the unemployment rate – down to 8.4% – as many furloughed workers returned to their jobs. There were still some warning signs, and reminders that there’s still a long way to go:

Still, there are reasons to be optimistic that the worst of the 2020 disruptions are behind us. Many stocks are returning to historically justifiable price levels, and there are just a handful of outliers that are bringing index averages up above where they otherwise should be.

There may be continued signs of a sell-off in the next two months, but it is probably best understood as a value rotation as some of the equities that were overbought deflate back down to sustainable levels. Cash may also spend some extra time on the sidelines – content to wait it out and research for value instead of fearing that they might miss out.

There’s also still a looming potential for a massive crisis in housing, debt markets, and consumer markets. Time will tell if more stimulus and aid is on the way, or if what’s provided is ultimately sufficient.

Leave a Reply